Explore ideas, tips guide and info Benni Catrina

Residential Energy Tax Credits 2025. Department of energy (doe), the u.s. A nonrefundable tax credit allows taxpayers to lower their tax liability to zero, but not below zero.

Before 2025, buildings qualifying for the 45l tax credit needed to consume at least 50% less heating and cooling energy than those. The energy efficient home improvement credit can help homeowners cover costs related to qualifying.

Form 5695 Fill out & sign online DocHub, The inflation reduction act of 2025 created two programs to encourage home energy retrofits: A nonrefundable tax credit allows taxpayers to lower their tax liability to zero, but not below zero.

Residential Energy Tax Credits Overview and Analysis UNT Digital Library, Before 2025, buildings qualifying for the 45l tax credit needed to consume at least 50% less heating and cooling energy than those. Home electrification from the ira.

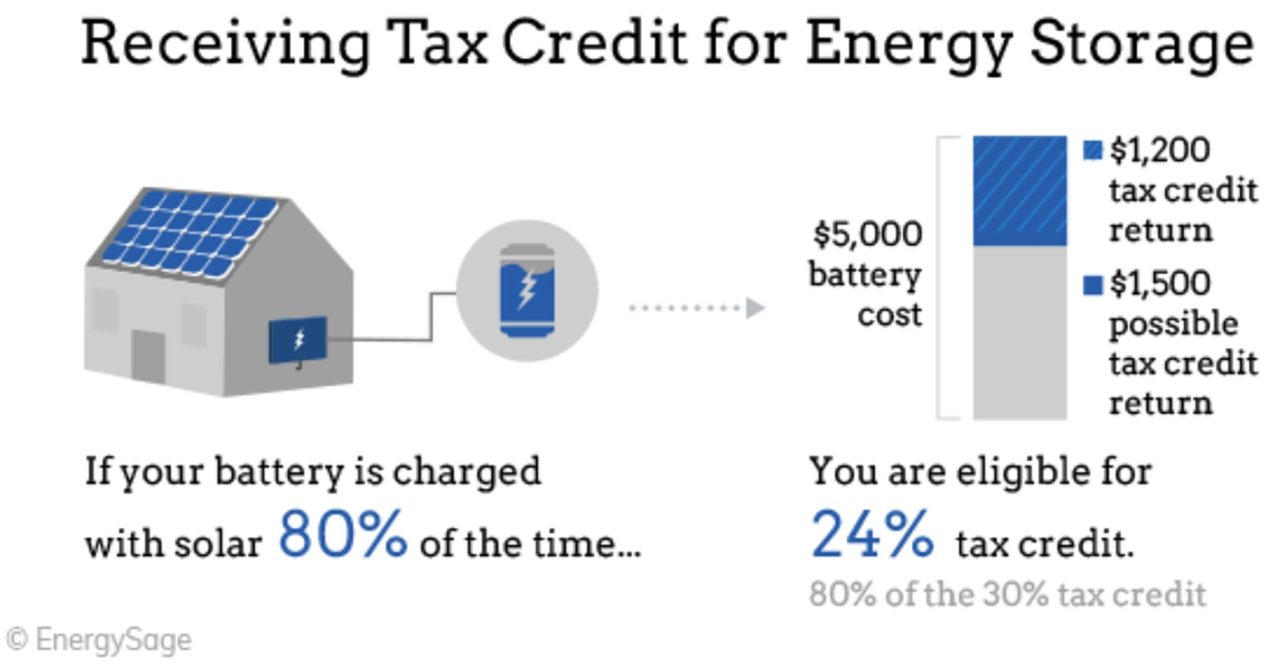

Solar Tax Credit What You Need To Know NRG Clean Power, The tax breaks are designed to encourage people to make their homes more energy. You either own the solar system outright (bought with cash or financed but not leased or part of a power purchase agreement with the solar company) or you have.

Residential Energy Tax Credits Elements, Analyses and Design Issues, Water heating is responsible for roughly 13% of both annual residential energy use and consumer utility costs, and these new. A nonrefundable tax credit allows taxpayers to lower their tax liability to zero, but not below zero.

New Residential Energy Tax Credit Estimates Eye On Housing, Installing alternative energy equipment in your home such as solar panels, heat pumps, windows, doors and roofing. The inflation reduction act of 2025 created two programs to encourage home energy retrofits:

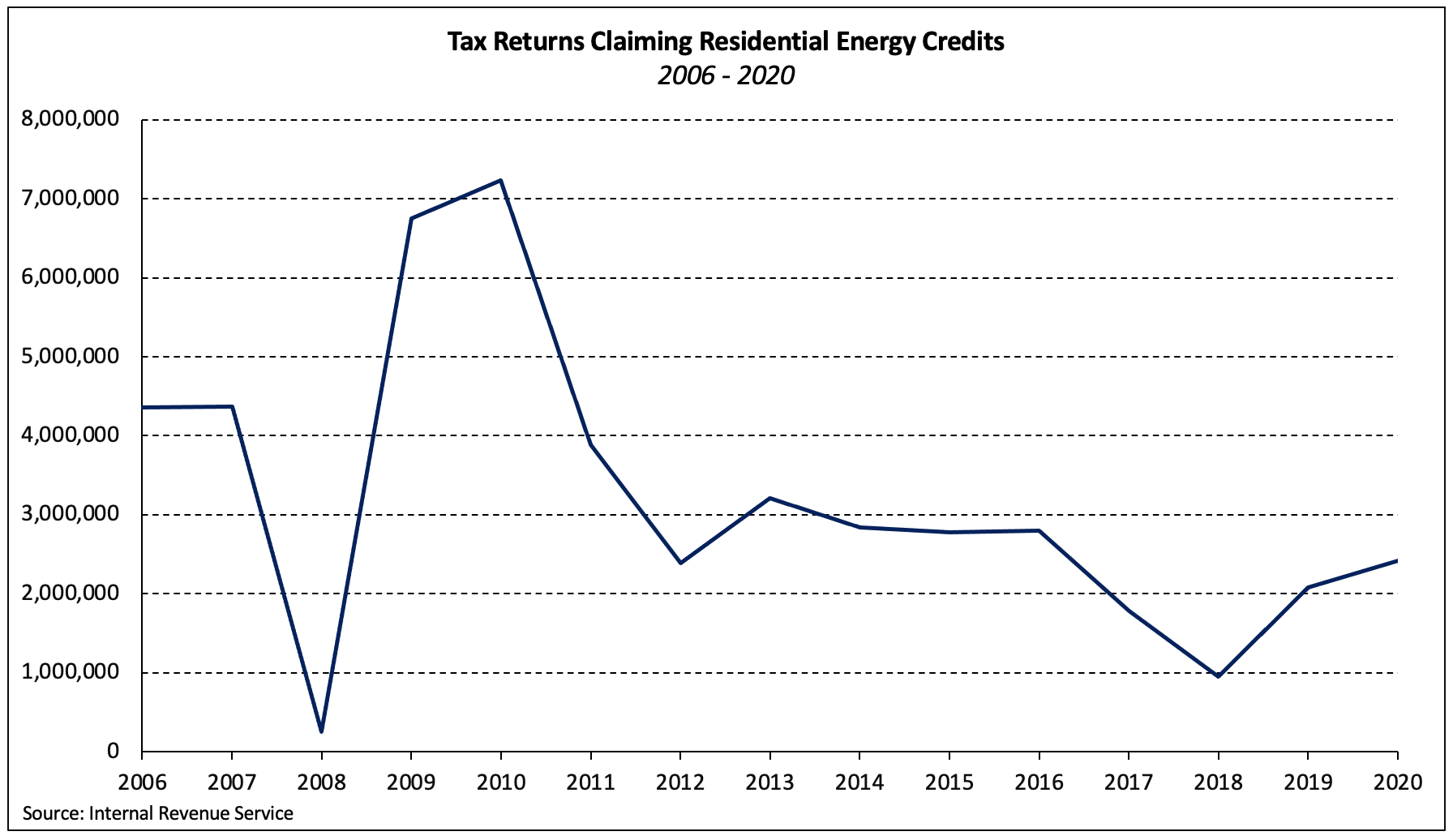

Use of Residential Energy Tax Credits Increases Eye On Housing, Here’s a look at a. Installing alternative energy equipment in your home such as solar panels, heat pumps, windows, doors and roofing.

Federal Solar Tax Credits for Businesses Department of Energy, Previously, individuals were allowed a personal tax credit, known as the residential energy efficient property (reep) credit, for solar electric, solar hot water, fuel cell, small wind energy, geothermal heat. Energy efficiency rebates and tax credits in 2025:

How to File IRS Form 5695 To Claim Your Renewable Energy Credits, We are reaffirming our 2025 earnings guidance range of $2.99 to $3.13 per share. How do i apply for the 2025 oeptc?

Final Days of the 30 ITC Solar and Energy Storage Tax Credit Briggs, The solar tax credit, which is among several federal residential clean energy credits available through 2032, allows homeowners to subtract 30 percent of. What tax credits are available?

Use of Residential Energy Tax Credits Increases Eye On Housing, How to make the most of energy efficiency tax credits in 2025. Before 2025, buildings qualifying for the 45l tax credit needed to consume at least 50% less heating and cooling energy than those.

Beginning with the 2025 tax year (tax returns filed now, in early 2025), the credit is equal to 30% of the costs for all eligible home improvements made during the.

Proudly powered by WordPress